The Congressional Insider Trading Conflict of Interest

October 23, 2023Feature Article(Source)

On February 13, 2020, former Senator Richard Burr sold between $628,000 and $1.7 million in personal stocks. A week later, the stock market crashed because of anxiety concerning the COVID-19 Pandemic. However, prior to his trades, Burr projected confidence in the US’s response to the pandemic. Hours before he sold the shares, Burr was briefed on the worldwide effects of the virus. The Securities and Exchange Commission and the Department of Justice subsequently investigated Burr for insider trading but eventually ended investigations with no consequences.

Richard Burr was not the only senator to sell stocks before the stock market crash, and neither is he the first lawmaker to make questionable trades. Former House Speaker Nancy Pelosi has been criticized for her husband’s success in the markets, former House Representative Chris Collins pleaded guilty to insider trading and was sentenced to 26 months in prison, and many other members of Congress have been accused of using nonpublic information to place trades.

Congressional stock trading risks a conflict of interest in policymaking and insider trading. If legislators are trading stocks, there is the risk that legislators will write laws and expend efforts to benefit their private stock holdings rather than the public’s interest. There is also the risk of insider trading. Because Congress is privy to information prior to the public, legislators have material, nonpublic information they can use to buy or sell securities, falling squarely within the definition of insider trading. Insider trading hurts investors because it is no longer a fair market when information is released to some groups before others. Whenever investors make decisions based on the news, their trades will never be as profitable as traders who get information earlier and act earlier. By the time investors get the information, the stock will be either more expensive to buy or less profitable to sell, creating an unfair trading advantage for those who have information and use it earlier. Investors will ultimately lose confidence in the markets and in the government system as a whole.

Why should the public care? Some proponents of Congressional trading argue it is a free market and anyone should be able to buy and sell stocks. As elected officials, Congress should serve the public rather than their own private interests. Constituents cannot trust their representatives to adequately represent constituent interests when their representatives have divided loyalties. Some could also argue if Congressmembers are so successful, investors could simply invest in the same stocks. While investors could follow a Congressperson’s trades, no investor will ever be as profitable as an investor with inside information. Further, mimicking a Congressmember’s portfolio will only help that Congressmember gain market influence, become wealthier, and start to control the market. Investors will think Congressmembers are more profitable, invest in the same stocks, and enrich Congressmembers by raising or deflating the value of a stock. In this system, publicly elected officials would essentially take a guaranteed premium or discount on investments from the public.

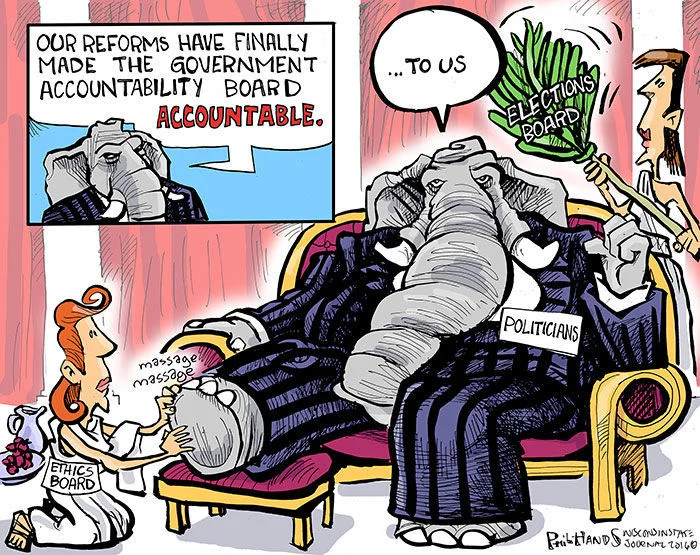

So why has this issue persisted? From a government standpoint, the checks and balances system failed. In theory, legislators are supposed to make the laws and the executive branch is supposed to enforce the law. However, there are very few Congressional stock trading laws because the necessary laws apply to the very people who make the laws. There is a conflict of interest because legislators do not want to make laws against their own interests. When there is no law to enforce, the executive branch cannot create their own laws or effectively enforce them.

Further, insider trading is difficult to prosecute. It is difficult to differentiate between illegal and harmless trading. Many times, there are not enough trading restrictions for the executive branch either. Enforcers have been found to frequently not report trades and trade stocks their agencies oversee. Enforcers do not want to enforce laws against themselves, and legislators do not want to make laws against themselves.

As legislators contemplate a solution to Congressional stock trading, legislators need to balance integrity, freedom to trade, accountability, and enforcement. How do regulators enforce the rules? How can public officials trade stocks in good faith? What standard should enforcement be required to prove to begin disciplinary measures?

In 2012, former President Obama signed the Stop Trading on Congressional Knowledge Act (STOCK Act) into law, banning Congress members and the executive branch from using nonpublic information for insider trading and requiring regular financial disclosures to facilitate enforcement. However, a year later, President Obama quietly signed a bill eliminating the STOCK Act’s requirement to post Congress and the executive branch’s financial disclosures online. In other words, to monitor financial disclosures for insider trading, enforcers have to travel to Washington D.C. for the physical copies stored in the Cannon House Office Building basement. This change to the STOCK Act eliminates accessibility and transparency, making accountability difficult when Congress members are not forthcoming with the records or the records are difficult to obtain. The policy justification cites “national security, personal security, and law enforcement issues.” However, Congress and the executive branch need to weigh these concerns against transparency, accountability, and public trust in elected officials.

Other efforts to restrict insider trading include but are not limited to the Ending Trading and Holdings in Congressional Stocks (ETHICS) Act and the Ban Stock Trading for Government Officials Act. The ETHICS Act is a bill prohibiting Congress members and their close relatives from trading individual stocks, securities, commodities or futures but allows diversified assets like mutual funds and qualified blind trusts. The penalty for trading is at least a Congressmember’s monthly pay. Further, the ETHICS Act would reinstate disclosure requirements from the STOCK Act. Similarly, the Ban Stock Trading for Government Officials Act is a bill that bans trading everything including stocks and qualified blind trusts, except for mutual funds and index funds. The penalty for trading under the Ban Stock Trading for Government Officials Act is at least 10 percent of the prohibited trade value and the Act would, like the ETHICS Act, also reinstate the public database requirement from the STOCK Act.

Both Acts are steps in the right direction with greater transparency from reinstating the STOCK Act’s database requirement, limiting flagged trades, and penalizing violations. The greater transparency will allow easier prosecution and enforcement by creating accessibility to records and easier tracing between trades. While politicians’ security is an issue, a possible reform could be to increase safeguards rather than decrease accountability. Legislators or enforcers could increase monitoring on Congressmembers’ financial accounts to prevent financial attacks and simultaneously track trades. Banning stock trades seems extreme but some company policies prohibit private sector employees from trading certain stocks as well. A public official sworn to serve the public should be more committed to public trust and integrity rather than preserving free market economics. However, if financial wellbeing is still a concern, these reforms still allow Congressional members to invest in mutual funds or other diversified assets. While both Acts seem acceptable if properly enforced, the ETHICS Act may garner more support as it allows blind trusts. The ETHICS Act also administers a more appropriate monthly pay penalty whereas a 10% fine under a Ban Stock Trading for Government Officials Act violation theoretically has less deterrent and retributive effects. Only time will tell whether either Act will receive enough votes.

Suggested Citation: Andrew Pei, The Congressional Insider Trading Conflict of Interest, Cornell J.L. & Pub. Pol’y, The Issue Spotter (October 23, 2023), https://live-journal-of-law-and-public-policy.pantheonsite.io/the-congressional-insider-trading-conflict-of-interest/.

You may also like

- April 2024

- March 2024

- February 2024

- November 2023

- October 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- November 2019

- October 2019

- September 2019

- April 2019

- February 2019

- December 2018

- November 2018

- October 2018

- September 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- May 2017

- April 2017

- March 2017

- February 2017

- December 2016

- November 2016

- October 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- August 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- June 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- April 2011

- March 2011

- November 2010

- October 2010

- September 2010