Who Gets the Big 199A Tax Loophole?

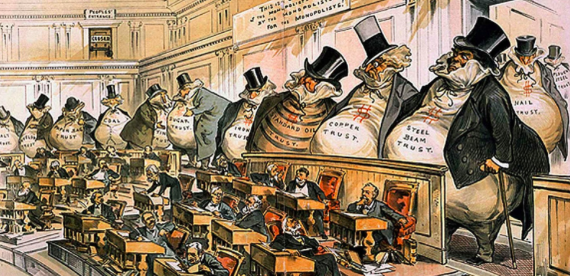

In December 2017, Congress signed the Tax Cuts and Jobs Act (TCJA) into law. It was largely unpopular for most Americans but has left some people and companies quite pleased—the ultra wealthy ones like the Koch Brothers and Pfizer.

The TCJA has lowered the individual income tax from 39.6% to 37%, lowered the corporate income tax from 35% to 21%, and doubled the estate tax’s exemption to $11 million per person and $22 million per couple.

One of the most glaring issues with the TCJA comes from a loophole created in the Internal Revenue Code section 199A Qualified Business Income. Corporate income is a type of business income that is taxed twice federally, once at the corporate level and once at the shareholder level. However, pass-through income is a type of business income that skips the corporate level tax and jumps straight into the owner’s personal tax returns. Section 199A potentially allows a major tax deduction for certain “qualified” pass-through income. One question is who will qualify for this deduction, the majority of Americans or only the wealthiest among them—my pennies are on the latter.

199A—Some of What is Known

The new law offers a 20% deduction for pass-through entities, such as S corporations, sole proprietorships, partnerships, real-estate investors, real estate investment trusts (REITs), and qualified cooperatives on their qualified business income. 199A does not offer a deduction for the performance of service as an employee. The pass-through deduction has been available since January 1, 2018 and is only available until December 31, 2025. Only taxable income (not gross income) that is subject to ordinary tax rates and considered qualified business income will be counted for the deduction. Also, 199A’s tax savings are equal to the deduction (whatever it may be) multiplied by the taxpayer’s top tax-bracket rate—so if the taxpayer ends up getting a $100,000 deduction and falls in a tax bracket that has a 12% tax rate, they will save $12,000 of tax. To qualify for 199A, single taxpayers earning more than $157,500 and married taxpayers filing joint returns making more than $315,000 need to either hold depreciable property or pay wages to get the deduction.

Who is qualified for the 199A deduction?

Not all service businesses are treated equally. 199A disallows some “white collar” professionals—such as doctors, lawyers, and accountants—from claiming the deduction by decreasing linearly the deduction allowed for income between $157,500 and $207,500 for individuals and between $315,500 and $415,500 for joint filers. So, if you are in this group and your income is above either $207,500 as an individual or $415,500 as a joint filer, your deduction is entirely phased out. This phase-out rule applies to professions including musicians, athletes and investment bankers, as well. If your income is below the phase-out threshold or you are not categorized in one of those disallowed groups, you might qualify for 199A, unless you fall into the vague disallowed catchall described in Internal Revenue Code section 1202(e)(3)(A): income does not count as qualified business income if it comes from a “trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees.” What does “principal” mean? Whose reputation is not the principal asset of such trade or business? Your guess is as good as any.

Who benefits from the 199A deduction?

Lily Batchelder (a professor at NYU Law) asserts that the sure winners from 199A are some current pass-through companies with lots of physical assets or employees. For example, someone like President Trump, who has more than 500 large pass-through real estate firms, will likely benefit from this new rule. In fact, the country’s highest earners (the top 1%) earn more than 50% of the country’s pass-though business income.

What about low-income and middle-class workers? Since employees do not qualify for the 199A deduction, can workers drop their employee status and become independent contractors to get the pass-through benefits? It is possible, but it may be more burdensome than beneficial for low- and middle-class taxpayers. First, the TCJA meagerly describes how workers can qualify for the deduction—most taxpayers will not know until later in the year when the Treasury has come out with some regulations to clarify how workers can get the 199A deduction. Second, switching to an independent contractor probably means dropping employee benefits, such as health insurance and a pension plan because one major factor the IRS uses to determine if a worker is an independent contractor or an employee is through the benefits that the worker receives. In addition, now the worker will have to pay the payroll tax that her employer would normally pay. Does this sound like a favorable tradeoff? Probably not for most Americans working to make ends meet.

199A also disallows deductions for “reasonable compensation paid to the taxpayer by any qualified trade or business of the taxpayer for services rendered with respect to the trade or business.” So, depending on how the Treasury defines what the TCJA means by that, the worker might have to creatively argue that what she is being paid is “unreasonable” as an independent contractor in order to get any deduction. One can only speculate what the Treasury regulations will decree.

Conclusion

If you are wondering how to use 199A to your advantage, you should talk with a tax attorney or strategist. However, even this is more proof that 199A primarily benefits wealthy individuals, since the wealthy are usually the only ones who have the money to pay for quality tax advice. As it stands now, 199A does not seem like it was designed to help lower taxes for low- and middle-class taxpayers, and I doubt the Treasury regulations will change that.

Suggested citation: Michael Chou, Who Gets the Big 199A Tax Loophole?, Cornell J.L. & Pub. Pol’y, The Issue Spotter, (Mar. 13, 2018), http://jlpp.org/blogzine/who-gets-the-big-199a-tax-loophole/.