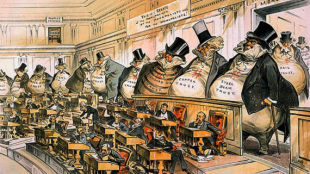

Who Gets the Big 199A Tax Loophole?

In December 2017, Congress signed the Tax Cuts and Jobs Act (TCJA) into law. It was largely unpopular for most Americans but has left some people and companies quite pleased—the ultra wealthy ones like the Koch Brothers and Pfizer. The TCJA has lowered the individual income tax from 39.6% to 37%, lowered the corporate income tax from 35% to 21%, and doubled the estate tax’s exemption to $11 million per person and $22 million per couple. One of the most glaring issues with the TCJA comes from a loophole created in the Internal Revenue Code section 199A Qualified Business Income. Corporate income is a type of business income that is taxed twice federally, once at the corporate level and once at the shareholder level. However, pass-through income is a type of business income that skips the corporate level tax and jumps straight into the owner’s personal tax returns. Section 199A potentially allows a major tax deduction for certain “qualified” pass-through income. One question is who will qualify for this deduction, the majority of Americans or only the wealthiest among them—my pennies are on the latter. 199A—Some of What is Known The new law offers a 20% deduction for pass-through entities, [read more]