Punishing the Victim: IRC §162(m) and the Limitation on Deducting Executive Compensation

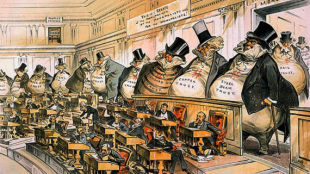

(Source) The phenomenon of punishing the victim is unfortunately a familiar one. Too often, a person in need of protection discovers that those whose ostensible task it is to assist not only do not offer the necessary protection but in fact exacerbate the harm. Here is a current example. Section 162(m) of the Internal Revenue Code provides that a publicly held corporation may not deduct compensation in excess of $1,000,000 paid to its principal executive office, its principal financial officer, or any of its three other most highly compensated employees (if the compensation paid to that employee is required to be reported to its shareholders under the Securities Exchange Act of 1934). Until 2017, IRC §162(m) was fairly easy to avoid as it did not apply to performance-based compensation: bonuses, stock options, and so forth. However, the 2017 Tax Cuts and Jobs Act eliminated this escape route. Today, regardless of how the compensation package is structured, the corporation can deduct a maximum of $1,000,000 for each of its covered employees. Underlying IRC §162(m) is the concern that the entrenched power of corporate management and the lack of effective oversight foster excessive executive compensation. The issue addressed by this provision is [read more]