Investor to Apple: Spend Your Cash

In the summer of 2006, as I prepared for my freshman year of college, my undergraduate university sent me a list of information pertaining to requirements for computers. I remember chuckling to myself when I saw that half of the information was reserved for Macintoshes. Who owned an Apple computer anymore? This was a time when iPods had been available for almost five years, but the introduction of the iPhone was still a year away and many people still abided by the slogan “Friends don’t let friends buy Macs.”

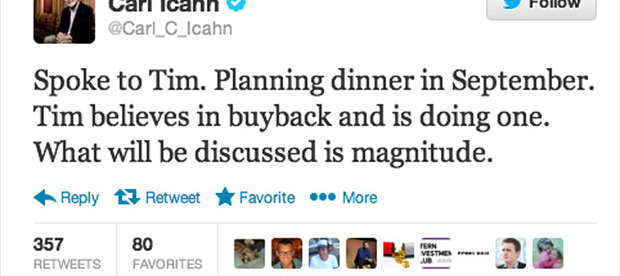

Fast forward to today: Apple is one of the most successful companies in the world and it has a consumer following that is unlike any other. And, it is sitting on $150 billion in cash. This fact has prompted one investor—activist shareholder Carl C. Icahn—to put pressure on Apple to return some of its money to the company’s shareholders. In a letter sent to Apple CEO Tim Cook on October 23, 2013, Icahn urged Apple to undertake a $150 billion buyback of its shares, financed with debt or a mixture of debt and cash.

The gist of Icahn’s argument is that, while he is completely supportive of Apple’s management, he feels as though Apple’s shares are irrationally undervalued. As of this writing, Icahn owns $3.88 million shares of Apple stock and the company’s stock price is hovering around $525 per share. When a company engages in a buyback, this exhibits confidence to investors and usually leads to an increase in the company’s stock value. From Icahn’s perspective, rather than sitting on the money, Apple might as well benefit from its cash by using it to increase stock value. If successful, Icahn stands to gain a lot of money on his $2.05 billion investment. It is no wonder why Icahn is even willing to engage in an expensive proxy battle in order to attain a seat on Apple’s board of directors.

Icahn’s campaign touches upon one of the most fundamental aspects of business law. It has long been established that “[a] business corporation is organized and carried on primarily for the profit of the stockholders [and the] powers of the directors are to be employed for that end.” Dodge v. Ford Motor Co., 204 Mich. 459, 507 (1919). The directors of a company have a fiduciary duty to act in the best interests of the shareholders as a whole. Indeed, Icahn’s letter to Tim Cook couches its proposal in language aimed at satisfying this requirement. Icahn wrote: “It is our belief that a company’s board has a responsibility to recognize opportunities to increase shareholder value, which includes allocating capital to execute large and well-timed buybacks.” Indeed, this case presents the very question as to what is in the shareholders’ best interests. Icahn argues that a “bigger and immediate” buyback will increase shareholder value, but more risk-averse investors are not convinced.

Unlike former CEO Steve Jobs, Tim Cook appears to be much more willing to work directly with Apple’s partners and investors. Under Cook’s leadership, Apple has already pledged to buy back $60 billion worth of stock between 2012 and 2015, and Apple has issued dividends for the first time since 1995. However, the timing of Icahn’s letter raises certain questions. In the two years since Steve Jobs’ death, many commentators have noted a decline in the excitement surrounding Apple’s product releases (although this point is subject to debate). Many argue that Apple is no longer leading the way in innovation, and some attribute this trend to the idea that Cook, while “as good as anybody can get,” is simply not the same as Steve Jobs. Whereas Apple stock is currently valued at $525 per share, the company’s stock once peaked at around $700 per share. While many shareholders would benefit from Icahn’s plan, it may not be in their best interests to reduce the company’s current cash holding to the extent proposed by Icahn.

Critics also argue that Icahn’s interests are short-term. If Apple buys back stock and the company’s stock value increases, there is nothing to prevent Icahn from selling his shares while the going is still good. Icahn has promised to demonstrate his good intentions by withholding his shares from the buyback, but the true benefit of his proposal will fall upon shareholders, like him, who maintain an interest in the company throughout the buyback process. In his letter to Tim Cook, Icahn wrote: “[I]rrational undervaluation as dramatic as this is often a short term anomaly. The timing for a larger buyback is still ripe, but the opportunity will not last forever.” If this is true and stock prices are bound to increase again, what is Icahn’s immediate incentive to boost stock prices? If Icahn’s interests are truly long-term, is he simply trying to increase his own influence by reducing competition in corporate voting and by reducing proxy solicitation costs?

Due to the strong criticism and skepticism surrounding his proposal, it is unlikely that Icahn will fully succeed in his campaign. However, it will be interesting to see how Apple moves forward with the interests of its shareholders in mind.