Who Gets the Big 199A Tax Loophole?

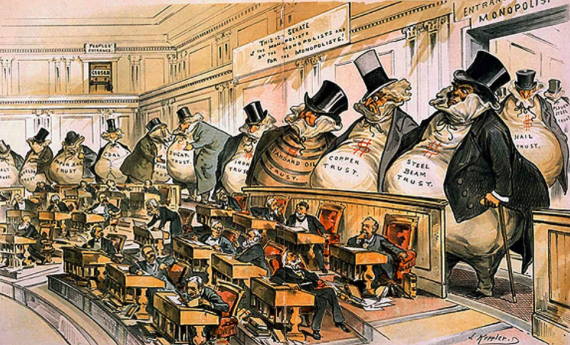

March 13, 2018Archives . Authors . Blog News . Feature . Feature Img . Recent Stories . Student Blogs ArticleIn December 2017, Congress signed the Tax Cuts and Jobs Act (TCJA) into law. It was largely unpopular for most Americans but has left some people and companies quite pleased—the ultra wealthy ones like the Koch Brothers and Pfizer. The TCJA has lowered the individual income tax from 39.6% to 37%, lowered the corporate income

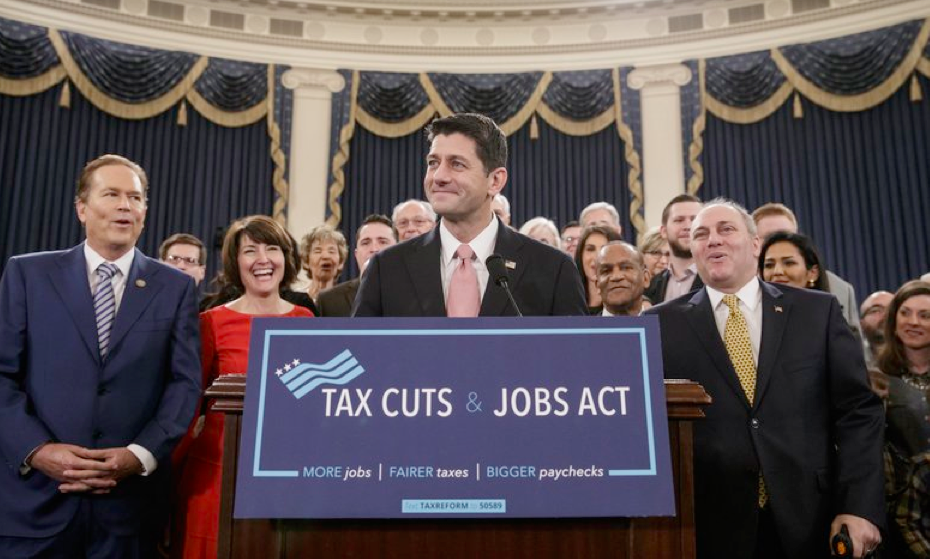

A Rushed Effort to Initiate Tax Legislation

January 31, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs ArticleOn Wednesday, September 27, 2017, the White House and Congressional Republicans revealed a new tax plan. Obtained and reported by the Washington Post, Congress released a nine-page document titled, “Unified Framework for Fixing Our Broken Tax Code,” which summarizes the proposed tax code reformations. With this tax plan, President Trump expects to bring “revolutionary change”