The 2017 Tax Reform and Its Effect on Renewables

September 21, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs ArticleAs the Tax Reform Act continues to be implemented, the wind and solar energy sectors will be key industries to watch. Most likely, the late 2017 tax legislation will dampen incentives to invest in the renewables industry.

“The Subject Was Muddy and Wet”: The Illegality of Zero Tolerance

September 17, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories ArticleThe disorder is a reminder of a grasping, struggling, messy attempt with no guarantee of successful entry, or even survival, by the end.

An Administrative Law Approach to Criminal Justice Reform

September 10, 2018Archives . Authors . Blog News . Feature . Feature Img . Recent Stories . Student Blogs ArticleWhile the main utility of fusion centers at their inception was avoiding future terrorist attacks, they quickly transformed into tools of local policing.

Fight or Flight: Explaining Minority Associate Attrition

March 21, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs . Uncategorized ArticleDiversity has been a prominent problem in the legal profession. Law is among the least diverse professions in the nation. According to a survey conducted in 2016, racial minorities represent about 20% of all attorneys at law firms. The industry has seen efforts to incorporate minorities into law schools and law firms, including minority mentorship

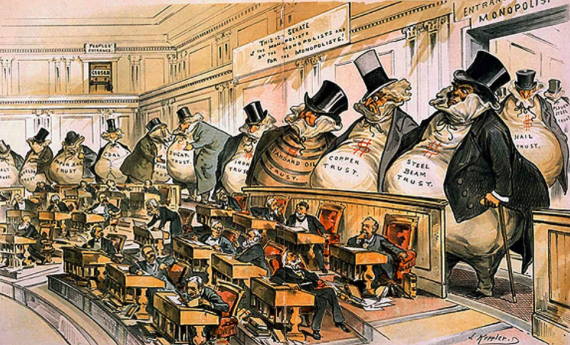

Antitrust Scrutiny of Vertical Mergers Under the Trump Administration

March 17, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs . Uncategorized ArticleThe business world welcomed the Trump administration with open arms, believing it would usher in a new era of unprecedented growth by disposing of many of the barriers implemented during the Obama Administration, such as Net Neutrality. During his first week in office, President Trump signed Executive Order 13771, which requires federal agencies to cut

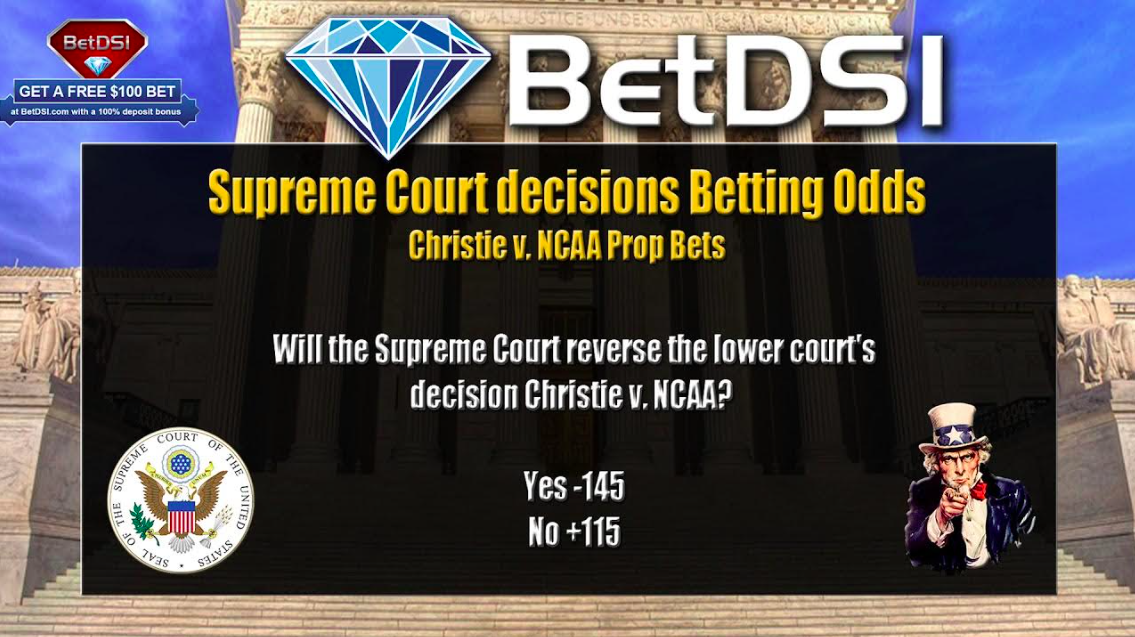

Christie v. NCAA and the Implications of Legal Sports Betting

March 15, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs . Uncategorized ArticleIn 1992, Congress passed the Professional and Amateur Sports Protection Act (“PAPSA”), prohibiting states from authorizing, licensing, regulating, and controlling sports betting. The Act grandfathered in states that had previously legalized sports betting – Nevada, Oregon, and Delaware – and offered an exemption to New Jersey if they enacted legislation within a year. The state

Who Gets the Big 199A Tax Loophole?

March 13, 2018Archives . Authors . Blog News . Feature . Feature Img . Recent Stories . Student Blogs ArticleIn December 2017, Congress signed the Tax Cuts and Jobs Act (TCJA) into law. It was largely unpopular for most Americans but has left some people and companies quite pleased—the ultra wealthy ones like the Koch Brothers and Pfizer. The TCJA has lowered the individual income tax from 39.6% to 37%, lowered the corporate income

Contract for Deed Sales Killing the American Dream

March 1, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs ArticleContract for deed sales, also known as installment land contracts, is an alternative way to purchase a home. Like the traditional home loan, buyers make a down payment and promise to pay the purchase price in installments; they are also responsible for making (and paying for) any necessary repairs and insurance. The buyer takes possession

Labor Strife in Major League Baseball

February 10, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs ArticleThe word “collusion” has been thrown around fairly frequently over the last few months in Major League Baseball (MLB). It is currently the baseball off-season, meaning that no regular-season games are currently played (and will not be until March). It is also during this time that teams are typically most active in trading and signing

Fair Play for Minor League Baseball

February 5, 2018Archives . Authors . Blog News . Certified Review . Feature . Feature Img . Recent Stories . Student Blogs . Uncategorized ArticlePeople are often quick to criticize professional athletes for the amount of money they make. And within the world of professional sports, baseball players often make more money than their peers in other professional sports. Some of the reasons for this, as some have pointed out, are that Major League Baseball (MLB) has no salary