Federalizing Privacy Rights: How Tech Giants Went From Protesting Privacy Laws to Supporting Them

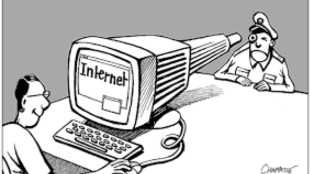

In an impassioned speech in Brussels this October, Tim Cook, the CEO of Apple, threw his weight behind a federal privacy law, denouncing the data collection practices engaged in by his fellow technological giants such as Google and Facebook. While it is not new for tech companies to push for stronger privacy laws, the renewed impetus for the movement comes from the European Union’s General Data Protection Regulation (GDPR), which went into effect on May 25, 2018, and California’s Consumer Privacy Act, which will go into effect on January 1, 2020. On the heels of California’s legislation, other states such as Georgia have also introduced similar bills. This patchwork of legislations across states with different levels of obligations has pushed the tech industries to petition Congress to enact a federal legislation. Earlier in November, Senator Ron Wyden (D–OR) introduced a federal privacy bill, but many news outlets report it as unlikely to be passed into law. While the tech companies’ interest may stem more from the desire to avoid compliance with 50 different laws on privacy, this post analyzes the public policy implications of a federal legislation on privacy for the complicated digital economy. Present federal protections for privacy rights: The current approach at the federal level in regulating [read more]